By Staff Reporter, | November 12, 2016

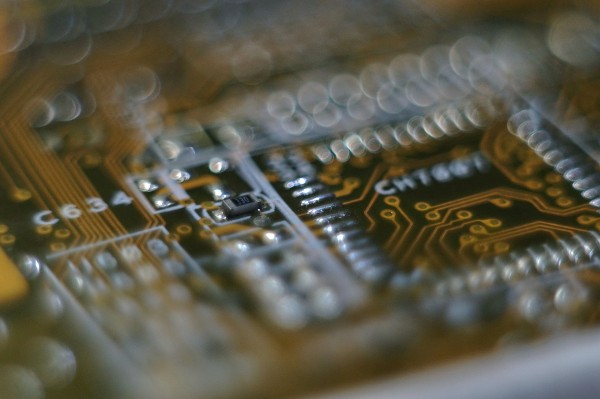

Invensense is allegedly exploring the possibility of a sale to Chinese and Japanese investors. (Pixabay)

US company Invensense Inc., which makes semiconductor devices and motion sensors for organizations like Apple Inc and Samsung Electronics Co., is exploring alternatives, including a possible sale, according to people familiar with the development, Reuters reported.

On the back of this news, the shares of the company rose by 13 percent to trade at $7.48 by afternoon, which resulted in the company gaining a market capitalization of nearly $700 million. If this sale goes through, Invensense would be the latest company to join the wave of consolidation.

Like Us on Facebook

Gyroscope maker looking at prospective suitors clandestinely

Chip maker Qualcomm bought NXP Semiconductors NV for about $38 billion this week in the biggest-ever semiconductor deal in the industry.

Gyroscope designer Invensense, which helps smartphones calculate motion, is exploring its options with an investment bank. Chinese and Japanese companies are allegedly among its prospective suitors.

Some critics are skeptical that the sale would be successful.

Tom Sepenzis, an analyst at Northland Capital Markets, mentioned that the growth of virtual reality in China could benefit Invensense products.

Invensense sensing Pokemon Go opportunity

Due to its unique product line, Invensense is well positioned in the Chinese market, Sepenzis noted.

The company, which competes with STMicroelectronics NV and Bosch Sensortech, received a boost with a positive rating from Pacific Crest Securities, in August. This was given based on the argument that gyroscopes are essential for mobile phones as well as for games like Pokemon Go.

Behrooz Abdi, Invensense chief executive, discussed the Pokemon Go opportunity during the company's earnings call in July.

-

Use of Coronavirus Pandemic Drones Raises Privacy Concerns: Drones Spread Fear, Local Officials Say

-

Coronavirus Hampers The Delivery Of Lockheed Martin F-35 Stealth Fighters For 2020

-

Instagram Speeds Up Plans to Add Account Memorialization Feature Due to COVID-19 Deaths

-

NASA: Perseverance Plans to Bring 'Mars Rock' to Earth in 2031

-

600 Dead And 3,000 In The Hospital as Iranians Believed Drinking High-Concentrations of Alcohol Can Cure The Coronavirus

-

600 Dead And 3,000 In The Hospital as Iranians Believed Drinking High-Concentrations of Alcohol Can Cure The Coronavirus

-

COVID-19: Doctors, Nurses Use Virtual Reality to Learn New Skills in Treating Coronavirus Patients